As car insurance evolves to meet the needs of today’s drivers, pay-per-mile insurance has emerged as a viable alternative for those who drive less frequently. This insurance model, also known as usage-based or pay-as-you-go insurance, charges drivers based on the actual number of miles they drive, potentially lowering premiums for low-mileage drivers.

This guide will dive into the essentials of pay-per-mile insurance, including its pros and cons, cost analysis, and tips for determining whether it’s a good fit for your unique driving needs. You’ll also find charts, tables, and expert advice to make an informed decision.

What Is Pay-Per-Mile Insurance?

Pay-per-mile insurance is a type of car insurance policy where your premium is calculated based on the miles you drive, along with a fixed monthly base rate that covers standard protection. It’s designed to offer flexibility and cost savings for drivers who don’t frequently use their vehicles. By aligning your insurance cost with your actual driving habits, pay-per-mile insurance can often save low-mileage drivers significant money compared to traditional insurance.

Example: If you drive 5,000 miles per year instead of the national average of around 12,000 miles, your risk of accidents is lower, and therefore, your premium is lower.

How Does Pay-Per-Mile Insurance Work?

Pay-per-mile insurance has two primary cost components:

1.Base Rate: This monthly charge remains fixed and provides essential coverages, such as liability and collision. It’s similar to the premium in traditional policies but typically lower.

2.Per-Mile Charge: This variable cost is calculated by multiplying the number of miles driven by a set rate per mile.

Example Calculation:

| Component | Monthly Cost | Details |

| Base Rate | $30 | Covers standard protection |

| Per-Mile Charge | $0.04 per mile | $0.04 × 500 miles = $20 |

| Total Monthly Premium | $50 | For driving 500 miles |

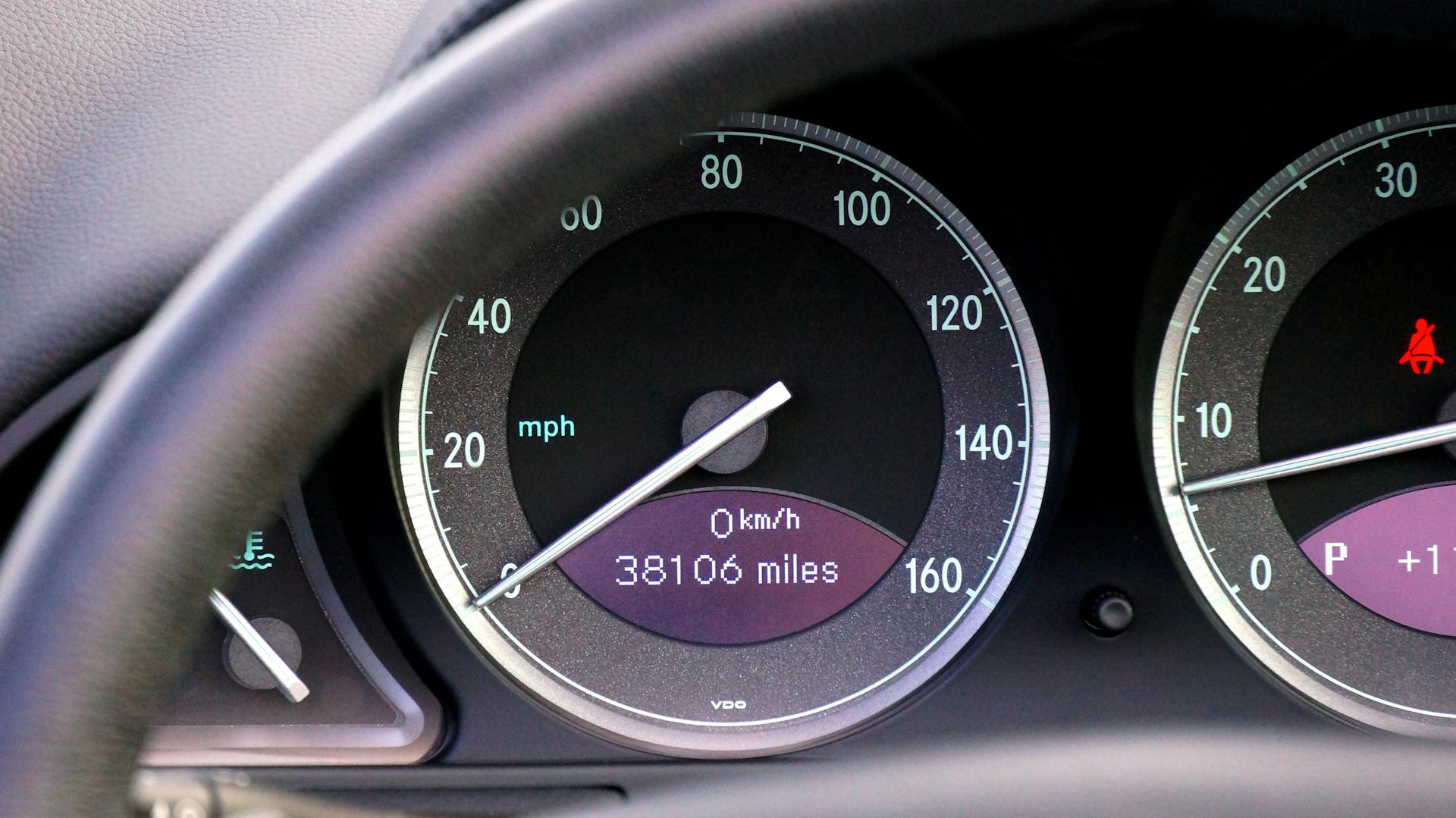

Tracking Miles

Insurers typically use a small device, also known as a telematics device, that plugs into your car’s OBD-II port. Alternatively, some providers offer app-based tracking through smartphones. These tools track your mileage accurately, ensuring you’re charged only for what you drive.

Who Should Consider Pay-Per-Mile Insurance?

Pay-per-mile insurance isn’t for everyone. It’s best suited for those who drive less than the national average. Here are some scenarios where it may be a good fit:

•Urban Residents: If you live in a city with excellent public transportation, you may not rely on your car daily.

•Work-From-Home Professionals: Those who primarily work from home likely drive less than traditional commuters.

•Retirees or Semi-Retirees: People who have retired or only occasionally use their vehicles may benefit.

•Second-Car Owners: If you own a secondary vehicle that you use infrequently, pay-per-mile can save on insurance costs.

Pros and Cons of Pay-Per-Mile Insurance

Let’s examine the advantages and potential downsides of choosing pay-per-mile insurance.

| Pros | Cons |

| Cost Savings for Low Mileage: If you drive less, you pay less. Ideal for low-mileage drivers. | Not Ideal for Long-Distance Drivers: High-mileage drivers may end up paying more than with a traditional policy. |

| Transparency: Charges are based on actual mileage, providing clear insight into premium costs. | Mileage Tracking Required: Some drivers may not like the idea of tracking their every mile. |

| Flexibility: Costs align with changing driving habits (e.g., less driving during a remote work period). | Additional Costs for Long Trips: Road trips or vacations can temporarily increase premiums. |

| Environmentally Friendly: Encourages reduced driving, benefiting the environment. | Limited Availability: Not all states or insurance companies offer pay-per-mile policies. |

| Accident Prevention Incentive: Low-mileage drivers statistically have fewer accidents. | Upfront Device Installation: Installing a telematics device can be inconvenient for some. |

Key Takeaway

Pay-per-mile insurance can be a money-saver for those who drive infrequently, but it’s essential to consider your driving habits and willingness to track mileage.

Cost Comparison: Traditional Insurance vs. Pay-Per-Mile Insurance

To understand whether pay-per-mile insurance is a better fit financially, let’s look at an example comparison:

| Driver Type | Annual Mileage | Traditional Policy (Annual) | Pay-Per-Mile Policy (Annual) |

| Low-Mileage Driver | 5,000 miles | $1,200 | $780 ($30 base rate + $0.04/mile) |

| Average Driver | 12,000 miles | $1,200 | $1,080 |

| High-Mileage Driver | 20,000 miles | $1,200 | $1,680 |

Analysis

•Low-Mileage Driver: Significant savings ($420 per year).

•Average Driver: Moderate savings ($120 per year).

•High-Mileage Driver: Pay-per-mile insurance is likely costlier than a traditional policy.

Key Factors to Consider Before Choosing Pay-Per-Mile Insurance

1. Your Annual Mileage

Estimate your yearly driving miles to see if you fall below the national average of around 12,000 miles. If you drive considerably less, pay-per-mile could be a great option.

2. Driving Patterns

If your mileage fluctuates—say, due to seasonal travel—it’s essential to consider how these changes impact your costs. Traditional insurance may be more economical if you have periods of high mileage.

3. Available Discounts

Some pay-per-mile insurers offer additional discounts, such as safe driving, bundling, or good student discounts. These can further reduce your premiums.

4. Provider Coverage and Reputation

Research companies that offer pay-per-mile insurance. Reputable names in this area include Metromile, Nationwide SmartMiles, and Allstate Milewise.

5. Mileage Tracking Preferences

Consider your comfort level with mileage tracking. While it can benefit low-mileage drivers, the continuous monitoring may not appeal to everyone.

Top Pay-Per-Mile Insurance Providers

| Provider | Base Rate | Per-Mile Rate | Average Savings | Key Features |

| Metromile | $29 per month | $0.06 per mile | 20-40% for low-mileage drivers | App-based mileage tracking, customizable coverage options |

| Allstate Milewise | $30 per month | $0.05 per mile | Up to 25% | No penalty for long trips, roadside assistance included |

| Nationwide SmartMiles | $28 per month | $0.04 per mile | Up to 20% | Flexible monthly billing, discounts for safe driving |

Each of these providers has different pricing structures and may offer additional benefits tailored to low-mileage drivers. Be sure to compare options and request quotes to find the best fit.

How to Switch to Pay-Per-Mile Insurance

If you’re interested in making the switch, follow these steps:

1.Review Your Current Policy: Check if your current insurer offers pay-per-mile options. Some major insurers allow you to switch without any additional fees.

2.Compare Quotes: Reach out to pay-per-mile providers to compare base rates, per-mile charges, and potential discounts.

3.Install Tracking Device or App: Once you’ve chosen a provider, they will likely require you to install a telematics device or app to track your mileage.

4.Review Your Premiums Regularly: Keep an eye on your monthly costs, especially if your driving habits change, to ensure pay-per-mile insurance remains the most economical choice for you.

Common Questions About Pay-Per-Mile Insurance

1. What happens if I go on a road trip?

Most pay-per-mile policies accommodate long trips by capping the maximum miles you’ll be charged daily. This means if you drive extensively for a short period, you won’t face exorbitant charges.

2. Is my location a factor in pay-per-mile pricing?

Yes, just like traditional insurance, pay-per-mile rates can vary by location, as some areas have higher accident rates or risk factors.

3. What if I don’t drive at all for a month?

If you don’t drive for a month, you’ll only be charged the base rate, effectively saving on per-mile costs for that period.

Conclusion: Is Pay-Per-Mile Insurance Right for You?

If you drive less than the average person, pay-per-mile insurance can offer significant savings and a more flexible pricing structure. By understanding your driving habits and comparing costs, you can find an option that aligns with your needs and budget.

Call to Action

Ready to explore pay-per-mile insurance? Get a quote from leading providers like Metromile, Allstate Milewise, or Nationwide SmartMiles to see how much you could save. Remember, each provider offers unique features and pricing structures, so take the time to find a plan that fits your driving habits best.

- When and How to Switch Home Insurance Providers for Better Rates – March 28, 2025

- The Role of AI in Home Insurance Claims and Policy Management – March 28, 2025

- How Digital Home Inspections Are Speeding Up Insurance Renewals – March 28, 2025