The rise of smart home technology has revolutionized how we interact with our living spaces, making homes more efficient, secure, and comfortable. But it has also begun to change the landscape of home insurance. From smart security systems to leak detection devices, these innovations are helping homeowners protect their properties better than ever before. This article will explore how smart home technology is influencing home insurance policies, the benefits it offers, and how it can affect premiums and coverage.

The Role of Smart Home Technology in Insurance

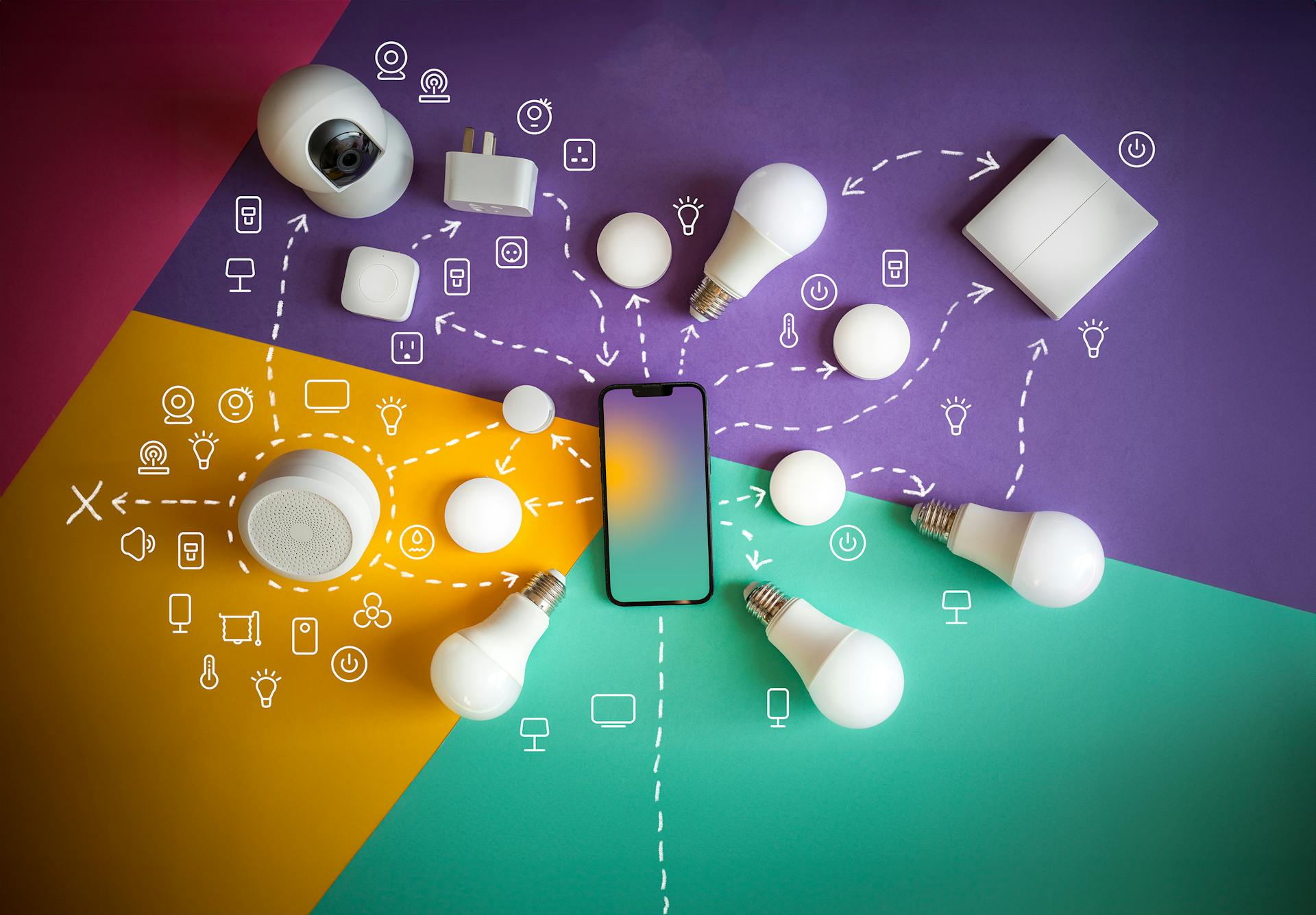

Smart home technology includes a wide range of devices that monitor, control, and automate various aspects of a home. These technologies offer valuable data and control that can help prevent damage, reduce risks, and lower the cost of home insurance.

Smart devices like:

- Smart thermostats (e.g., Nest or Ecobee)

- Smart smoke and carbon monoxide detectors (e.g., Nest Protect)

- Smart locks (e.g., August Smart Lock)

- Security cameras (e.g., Ring, Arlo)

- Water leak detection sensors (e.g., Flo by Moen)

are just a few examples of how technology is making homes safer and more energy-efficient. By gathering data on how the home is functioning, these devices provide homeowners with the information needed to prevent damage before it happens. Insurance companies are beginning to recognize these benefits, and many are offering discounts for homes equipped with smart technologies.

How Smart Technology Impacts Home Insurance Premiums

One of the most direct effects of smart home technology on home insurance is its potential to lower premiums. Since these devices can help prevent accidents, damage, or theft, insurance providers may see them as reducing risk and, therefore, reduce their rates accordingly.

Common Discounts Offered for Smart Homes

Many insurers offer premium discounts for smart home devices. These can vary from 5% to 20% off your premium, depending on the device and the insurer’s policy.

For example:

- Home security systems: Homeowners who install smart security cameras and alarm systems may qualify for a discount due to the reduced risk of theft or vandalism.

- Water leak detectors: By detecting leaks early, these devices can prevent water damage, which is one of the most common and costly claims. Insurance providers often reward homeowners for taking this proactive approach.

- Smart thermostats: By optimizing energy use and preventing issues like frozen pipes, these devices can reduce the risk of damage, potentially resulting in lower premiums.

The Potential for Lower Claims

Smart home technology can reduce the likelihood of claims being filed, which directly impacts premiums. For example:

- Fire and smoke detection: A smart smoke detector alerts homeowners to smoke or fire early, allowing them to take action before significant damage occurs.

- Water damage prevention: Water leak detectors can alert homeowners to leaks before they cause significant water damage, preventing mold growth and structural issues.

- Burglary prevention: Security cameras, doorbell cameras, and smart locks offer additional layers of protection, making it less likely that a home will be burglarized.

By reducing the number and severity of claims, smart home technology helps insurers manage their risk, which could lead to lower premiums for homeowners.

Smart Home Devices and Their Effect on Coverage

While smart home technology can reduce premiums, it may also impact the coverage provided by a homeowner’s insurance policy. Insurers may offer tailored policies or higher coverage limits for homes with advanced technology.

Understanding the Fine Print

Not all smart home devices will automatically result in lower premiums. Homeowners need to be aware of the following:

- Insurer requirements: Insurance companies may require homeowners to use specific devices from approved manufacturers. Be sure to verify that your devices meet your insurer’s requirements.

- Effect on coverage limits: Some insurers may increase coverage limits for homes with smart devices to account for the added protection these devices provide. However, coverage limits can also vary depending on the specific device and insurer.

It is crucial to read the fine print and discuss the impact of smart technology with your insurance provider to ensure that your policy accurately reflects your home’s features.

The Pros and Cons of Smart Home Technology in Insurance

Pros:

- Lower premiums: Insurance providers often offer discounts for homes with smart devices, reducing the cost of insurance.

- Reduced risk: Smart home devices can prevent damage from fire, water, and burglary, reducing the number of claims and protecting your home.

- Real-time alerts: Many smart devices offer real-time notifications, so you can take immediate action if something goes wrong, such as a water leak or fire.

- Increased home value: Smart homes often attract higher resale values, and smart technology can increase the appeal of your property to potential buyers.

- Personalized coverage: Some insurers offer customized policies that reflect the specific devices installed in your home, ensuring your coverage is optimized for your needs.

Cons:

- Initial cost: The cost of purchasing and installing smart home devices can be expensive, and it may take time to recoup those costs through insurance savings.

- Privacy concerns: Many smart devices collect personal data, and homeowners may have concerns about data security and privacy risks.

- Compatibility issues: Not all smart devices are compatible with each other or with every insurance provider, and homeowners may need to invest in certain brands or models.

- Limited discount opportunities: Some insurance companies may not offer significant discounts for smart devices, or they may not offer any discounts at all.

- Device failure: If a smart device fails or malfunctions, homeowners may not receive the expected benefits, which could affect their insurance coverage.

Steps for Leveraging Smart Technology to Lower Insurance Premiums

If you are interested in taking advantage of smart home technology to lower your premiums, consider the following steps:

- Research insurance providers: Not all insurance companies offer the same discounts for smart technology. Compare different providers to see which ones offer the most substantial savings for the devices you plan to install.

- Invest in high-value devices: Security systems, fire alarms, and water leak detection devices are typically the most beneficial for securing discounts.

- Verify device compatibility: Ensure the smart devices you choose are compatible with your insurer’s requirements. For instance, some insurers may only offer discounts for specific brands or types of devices.

- Regularly update and maintain devices: To keep your discounts, ensure that your smart devices are always up-to-date and in good working order.

- Report devices to your insurer: Notify your insurance provider once you’ve installed smart devices so they can adjust your policy and provide any discounts available.

Conclusion

Smart home technology is rapidly changing the way homeowners protect their properties, and its influence on home insurance policies is undeniable. By reducing risks such as fire, theft, and water damage, smart devices can lower premiums, offer more tailored coverage, and enhance the overall safety of a home. However, homeowners must be proactive in selecting the right devices, understanding their policy’s terms, and working with their insurer to maximize their potential savings.

Ultimately, the integration of smart technology into homes provides a win-win scenario for both homeowners and insurance providers, offering improved security, reduced risks, and the potential for lower premiums. As smart technology continues to evolve, it will likely play an even more significant role in shaping the future of home insurance.

- When and How to Switch Home Insurance Providers for Better Rates – March 28, 2025

- The Role of AI in Home Insurance Claims and Policy Management – March 28, 2025

- How Digital Home Inspections Are Speeding Up Insurance Renewals – March 28, 2025